In addition to the credit form in most cases you may also need to file form 3800.

Irs energy tax credit 2018.

Use these revised instructions with the 2018 form 5695 rev.

All references to the credit have been reinserted in these instructions.

If you file a form 1040 or 1040 sr schedule c you may be eligible to claim the earned income tax credit eitc.

If congress renews the nonbusiness energy property credit for 2018 it would be claimed by completing irs form 5695.

Claim the credits by filing form 5695 with your tax return.

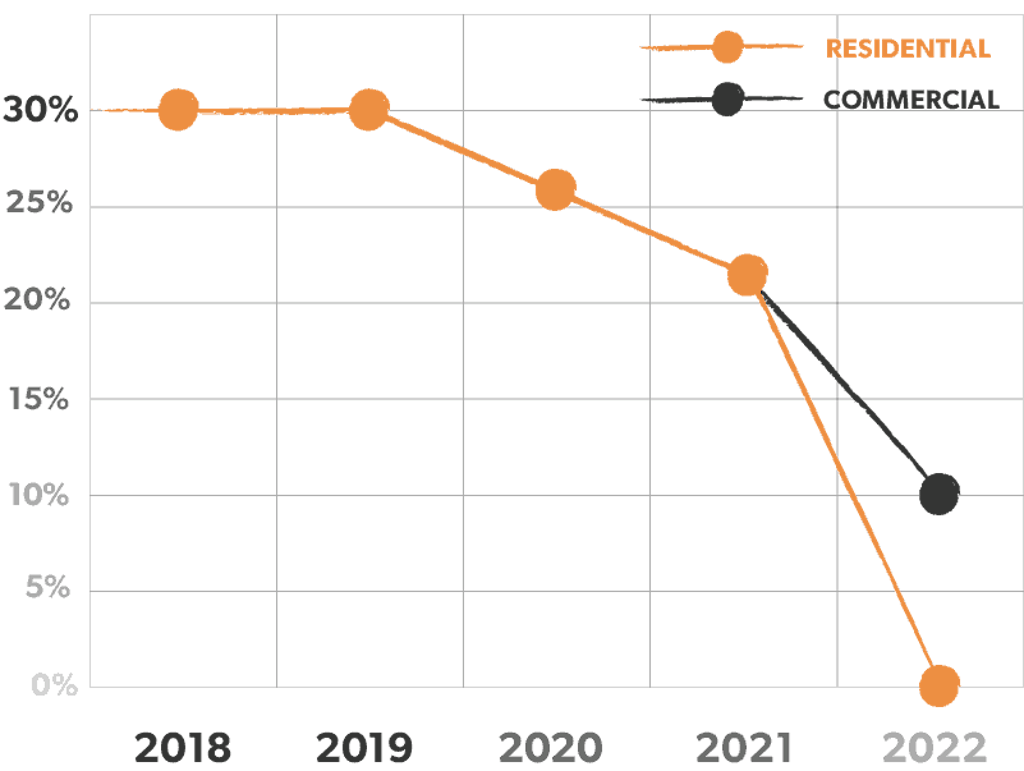

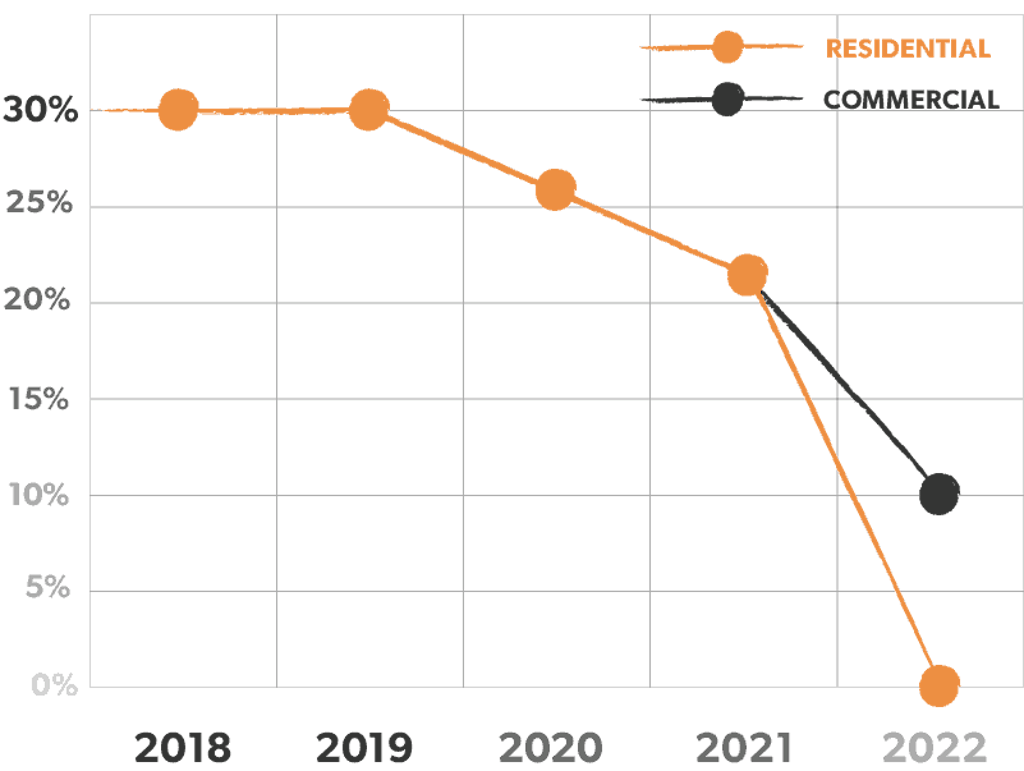

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

Recent legislation has made the nonbusiness energy property credit available for both 2018 and 2019.

February 2020 have been revised to reflect the extension of the nonbusiness energy property credit to 2018 by the taxpayer certainty and disaster tax relief act of 2019.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

This tax credit has unfortunately expired but you can still claim it for tax years prior to 2018 if you haven t filed yet or if you go back and amend a previous year s tax return.

Nonbusiness energy property credit is available for 2018 and 2019.

To claim a general business credit you will first have to get the forms you need to claim your current year business credits.

This means your home must be your main or primary home and the improvements to energy efficiency must meet specific energy standards.

Tax tip 2017 21 february 28 2017.

In 2018 and 2019 an individual may claim a credit for 1 10 percent of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500.

These instructions like the 2018 form 5695 rev.

Through the 2020 tax year the federal government offers the nonbusiness energy property credit.

The first part of this credit was worth 10 of the cost of qualified energy saving equipment or items added to a taxpayer s main home in the past year.

Irs tax tip 2017 21 february 28 2017 taxpayers who made certain energy efficient improvements to their home last year may qualify for a tax credit this year.

Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs.

To claim the credits you must meet all qualifying criteria.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

Federal income tax credits and other incentives for energy efficiency.

The credit had expired at the end of 2017.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

The residential energy credits are.