You can claim a maximum credit of 50 for advanced main air circulating fans 150 for a qualifying furnace or boiler and 300 for energy efficient building property.

Irs energy efficient tax credit 2018.

This lifetime cap means that if you ve claimed at least 500 in credits in the past you won t be able to claim credits again in 2018 if congress renews the credit.

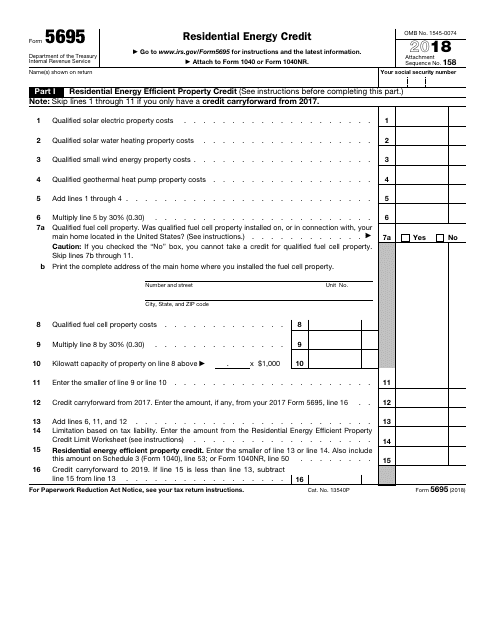

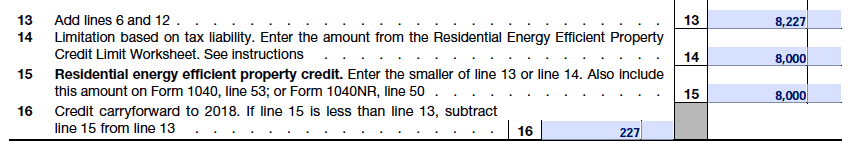

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

Form 8908 pdf information about form 8908 energy efficient home credit including recent updates related forms and instructions on how to file.

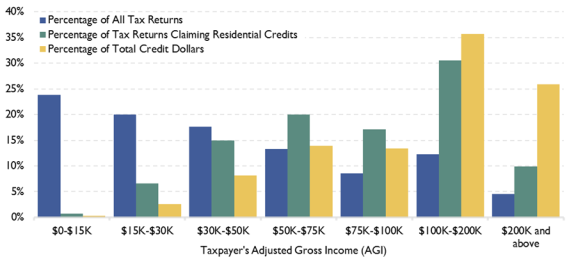

Residential energy efficient property credit this tax credit is 30 percent of the cost of alternative energy equipment installed on or in a home.

The residential energy credits are.

In 2018 and 2019 an individual may claim a credit for 1 10 percent of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500.

This includes the cost of installation.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

Eligible contractors use form 8908 to claim a credit for each qualified energy efficient home sold or leased to another person during the tax year for use as a residence.