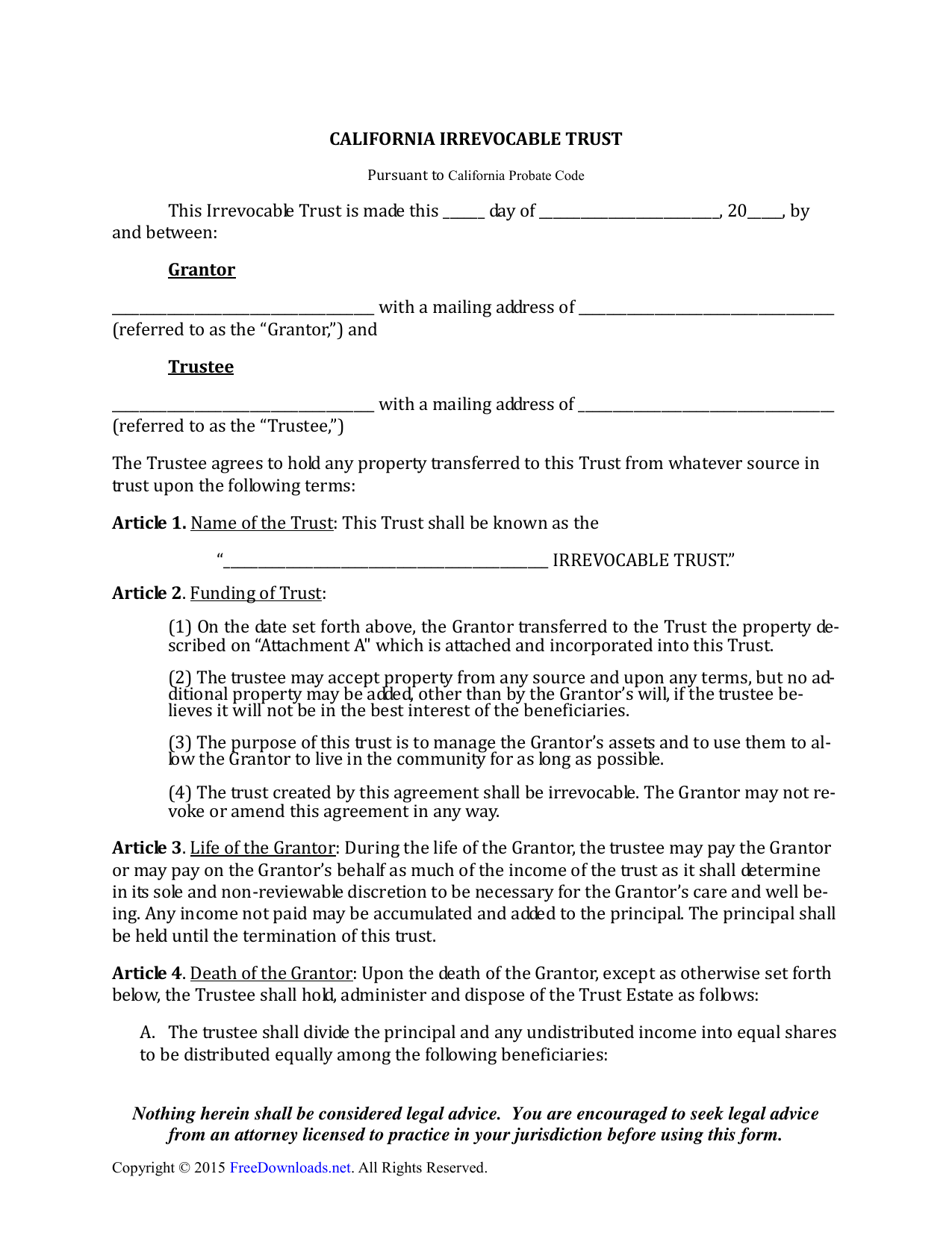

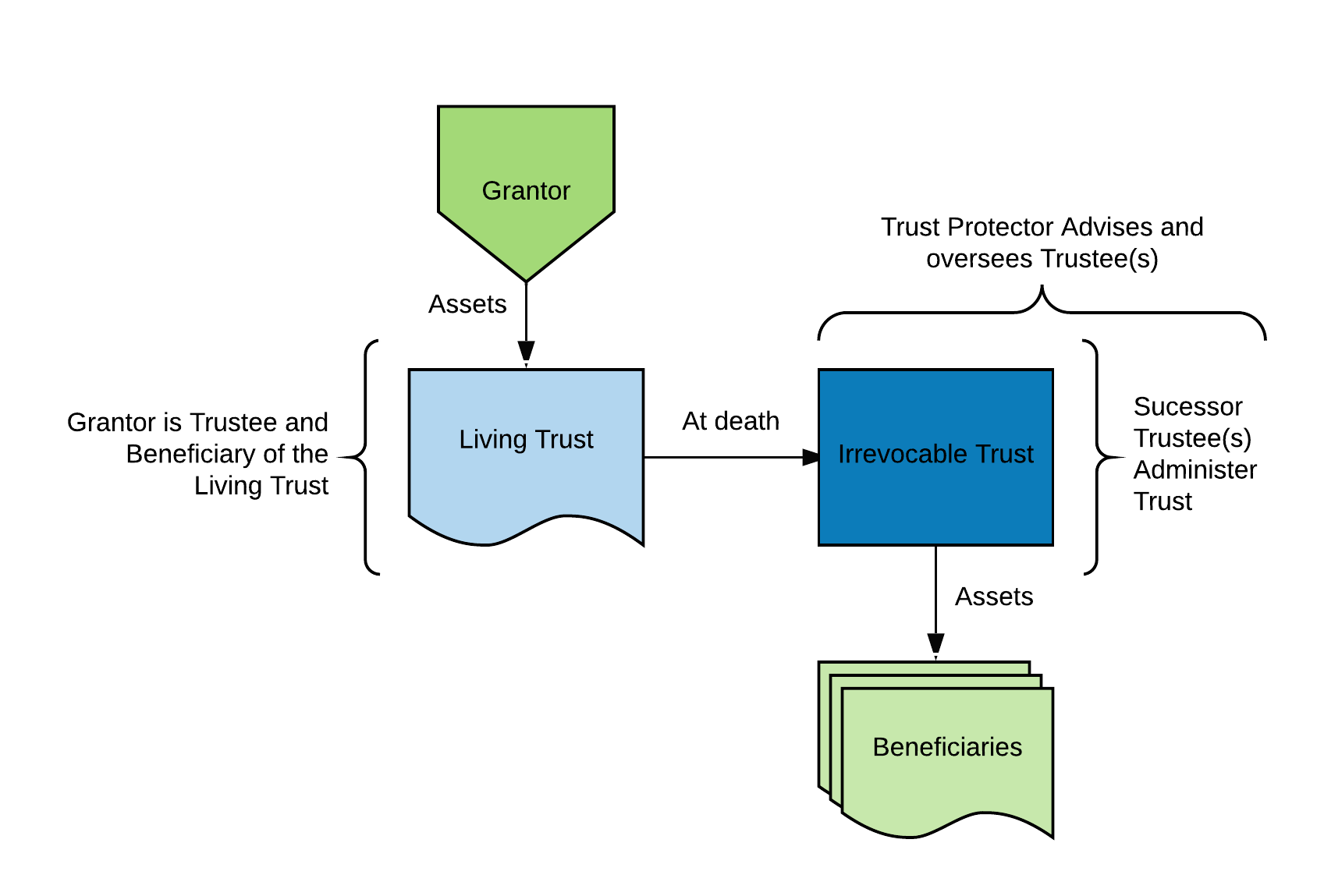

An irrevocable trust is an estate planning tool designed for the long term management of assets which are permanently transferred into the trust.

Irrevocable living trust california.

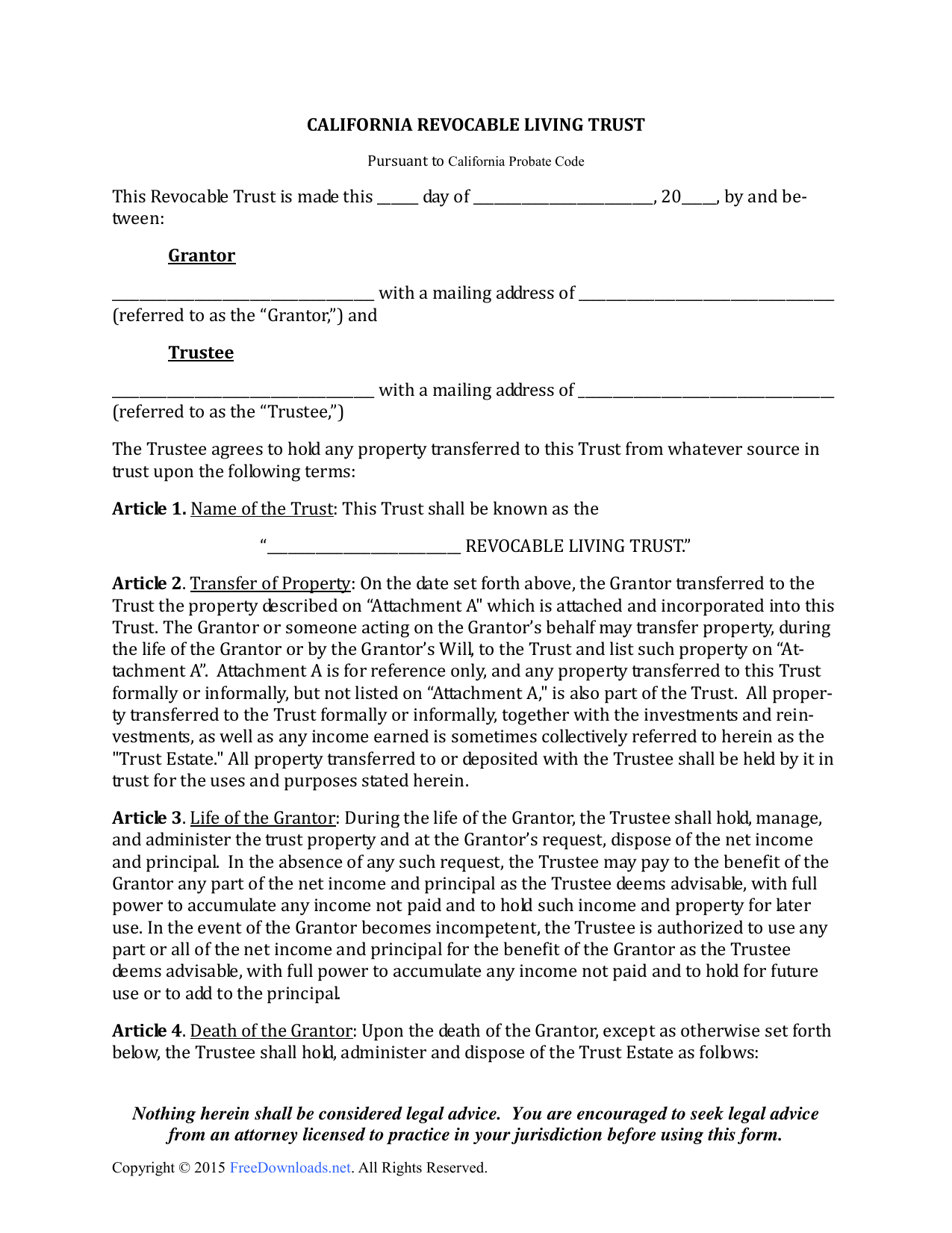

A california living trust is a document that enables an individual to manage their assets both during their lifetime and after death while avoiding the probate process the person establishing the trust the grantor can place their personal property and real estate within the trust so that it may be distributed directly to a beneficiary upon the grantor s death.

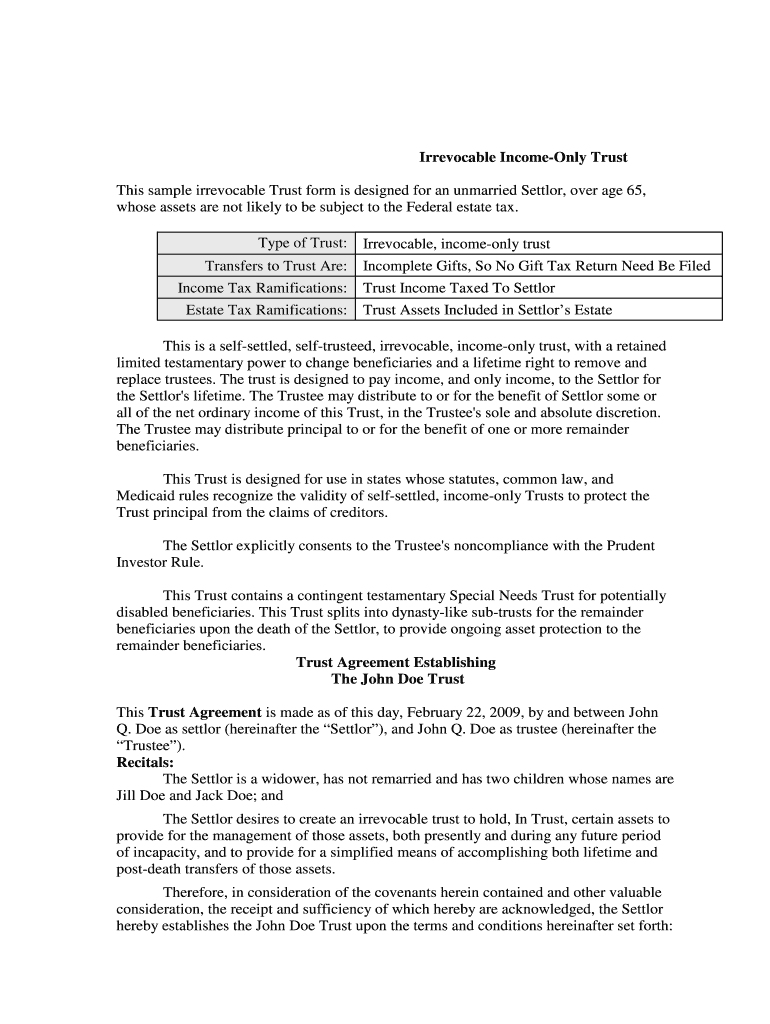

Irrevocable trusts are designed for the long term management of assets.

For example a california irrevocable trust is held for the benefit of a child until age 40.

Irrevocable trust beneficiary rights.

Tax benefits of irrevocable trust.

The trustee can distribute income for the support of the beneficiary but an opportunity arises where the purchase of a condo would best serve the beneficiaries support needs.

How to set up a living trust fund.

How does a living trust protect assets.

Fortunately california law allows for the amendment modification or termination of an otherwise irrevocable trust under the proper circumstances and using the proper procedures.

Can a living trust help save or reduce estate taxes.

Often the trust becomes an administrative trust until the.

To learn more about revocable trusts go here when talking about trusts the term living means that the trust goes into effect during the grantor s life.

The income from the trust assets is either taxable to the trust or to the beneficiary.

It states the trustee has a duty to keep the beneficiaries reasonably informed of the status of the probate process and the beneficiary can enforce their rights by filing a probate court petition.

In the estate planning law one of the most beneficial documents is a living trust it s crucial to note that not all living trusts are created equal and one of the most consequential decisions you ll have to make is whether you want an irrevocable living trust or a revocable living trust in california.

There are several kinds of living trusts that let you avoid reduce or postpone federal estate taxes.

The state bar of california 180 howard street.

This article will discuss those probate code sections that accommodate the seemingly contradictory goal of changing an irrevocable trust.

California probate code 16060 protects the beneficiary rights in california on irrevocable trusts.

This sets them apart from revocable trusts which can be terminated at least until they become irrevocable at the death of the trust maker the grantor.

When a california resident with a revocable living trust dies what was once a grantor trust taxable to the resident becomes an irrevocable trust with future income reported on a fiduciary return.

A california court will make the final determination on whether or not a revocable trust can be changed or revoked during divorce.

Irrevocable means the trust can t be changed or canceled this is often done for tax planning or to protect assets from creditors.